IRS Postpones April 15 Tax Deadline To May 17

Getty Images News

On St. Patrick's Day when most people saw green from the stimulus checks being delivered, the IRS extended the tax filing deadline.

I had to read it twice, but according to Marketwatch, more than 100 lawmakers pressured the IRS to make the decision, and so did some tax filers for older people and accountants. They said since the day the government would accept taxes was moved to February, the IRS should move the deadline too because the dates were too close together, so the decision was made to delay it to May 17.

IRS Commissioner Charles Rettig told Marketwatch that this is still a tough time for many people so if the IRS was going to help, then moving the date was the wise thing to do. The IRS was already under pressure after the new financial rescue bill was signed by President Biden.

If you remember, IRS pushed the deadline to July 15 also due to the pressures from the COVID-19 pandemic. According to Marketwatch, taxpayers can also delay payment of any money they owe the IRS until May 17. It was also reported that if people still need more time to submit their returns, they can request an extension.

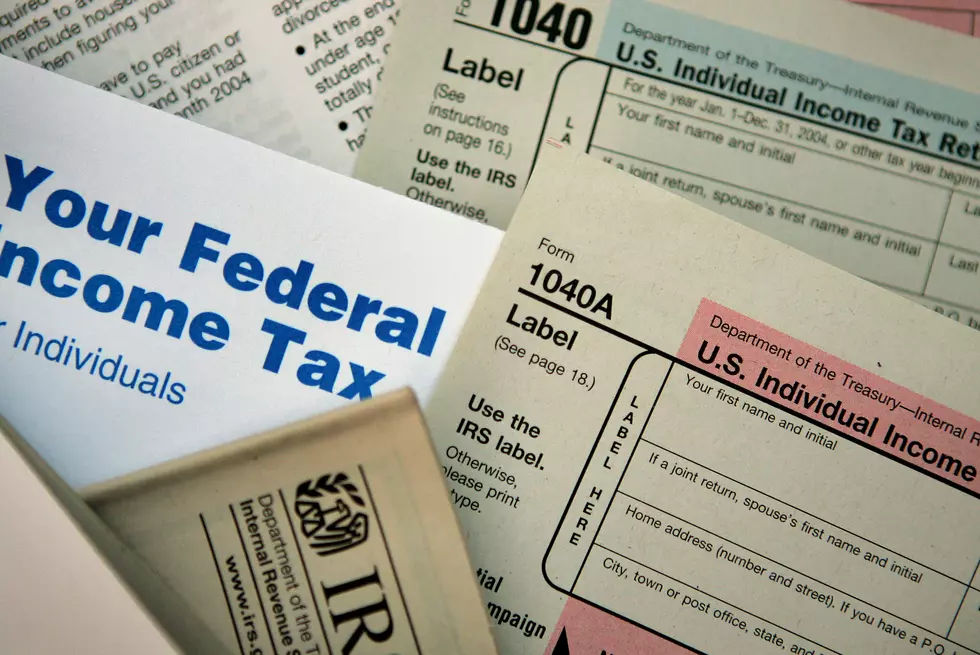

With the new money going out, some people still haven't got their last stimulus check. Bloomberg is reporting that people can file that they didn't get the money and use form 1040 in order to claim the payments. That is one of the exemptions that were passed for this year.

Something I didn't know is that just about everything has a check and balance, but the IRS can extend when taxes are due without anyone's approval. Bloomberg is reporting this tax extension comes as the IRS has been processing the third round of direct payments to households, this time for $1,400 each. The article said the IRS has sent out over 90 million payments totaling $242 billion. No wonder why they extended the due date.

Bloomberg is also reporting that the IRS is still behind in tax audits and processing, so this also comes at a time when the IRS needs a slow down or a break to catch up.

8 Things To Have Handy For Outdoor Dining In Duluth

FOR SALE: Feast Yer Eyes on This Pirate Ship

More From KRFO-AM